Technical analysis Investing is the study of past market data in order to predict future market movements. It is a powerful tool that can help you make more informed investment decisions. In this article, we will explore 10 tips for technical analysis investing.

1: Understand What Is Technical Analysis

Technical analysis investing is a type of security analysis that focuses on the use of past price and volume data to predict future prices. It involves studying patterns in the stock market, charting the movements of individual stocks, and looking for indicators that can help identify potential buying or selling opportunities. Technical analysis investors look for patterns in the market to determine when to buy and sell stocks, as well as how to adjust their portfolios in response to changing market conditions. While it is not always possible to predict the movement of a particular security, technical analysis provides traders with a powerful tool for making educated investment decisions.

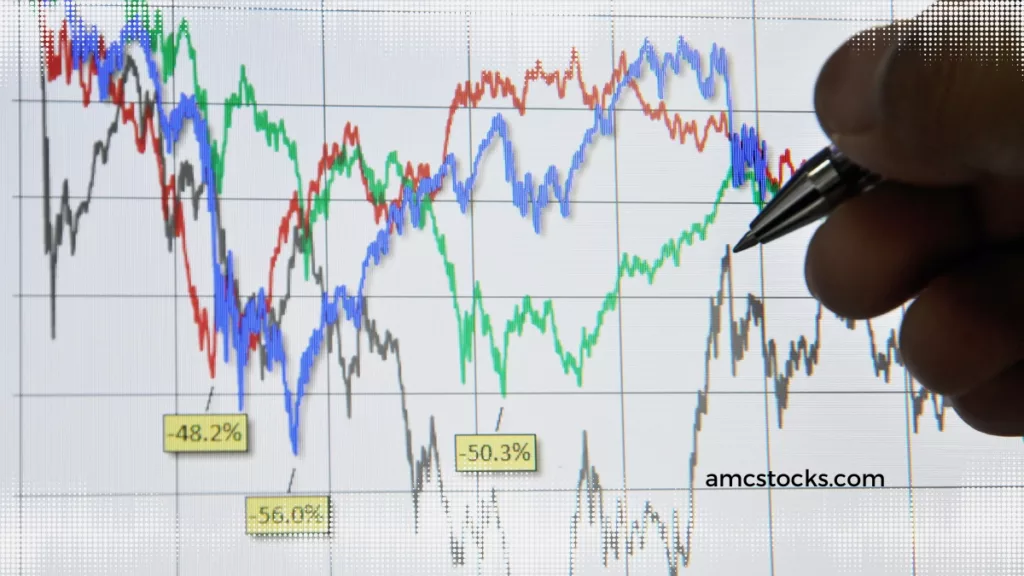

2: Study Historical Data

One of the key aspects of technical analysis investing is the study of historical data. By studying information such as past stock prices, trading volume, and other market indicators, investors can try to predict future market movements. Through this form of analysis, investors can identify trends and patterns that may indicate when to buy or sell certain stocks or other securities. Additionally, technical analysts often use various charting techniques to visualize this data in order to make more informed decisions. By understanding the past, investors can gain insight into potential future movements and make better decisions when it comes to their investments.

3: Understand The Basics Of Technical Analysis

Technical analysis investings is a form of stock market analysis that looks at past market data to predict future trends. It involves studying price charts and technical indicators to identify patterns and identify potential trading opportunities. Technical analysis can be used to predict the direction of a security’s price, its support and resistance levels, and its overall trend. As an investor, understanding the basics of technical analysis can help you make informed decisions when trading stocks, ETFs, and other securities.

4: Identify Trendlines And Moving Averages

Technical analysis investing involves the use of trendlines and moving averages to identify market trends and potential points of entry and exit. A trendline is a line drawn through a series of data points on a graph that shows the general direction in which the price is moving. Moving averages are used to smooth out short-term fluctuations in prices, making it easier to identify underlying trends. By combining these two tools, investors can gain a better understanding of the market and make more informed decisions when trading.

5: Look For Price and Volume Patterns

Technical analysis investing is a type of investing strategy that relies on the analysis of price and volume patterns to identify potential trading opportunities. It is based on the idea that past market data can be used to predict future price movements. By looking for patterns in both price and volume, investors can look for potential entry and exit points for their trades. Technical analysis investors also use indicators such as moving averages, Bollinger bands, and momentum oscillators to help them identify trends in the market. With the right approach, technical analysis investing can be a great way to identify profitable trading opportunities.

6: Use Indicators To Make Better Decisions

Technical analysis investing is a form of stock market investing that relies on examining past price trends and volume levels to make informed decisions about future stock performance. Using technical indicators such as moving averages, oscillators, and momentum indicators, investors can gain insight into price patterns and other market dynamics. By correctly interpreting the data from these indicators, investors can better predict what direction a stock price is likely to move in and use that information to make better decisions about when to buy and sell a stock.